The PAMM-account, as a financial instrument for investing in the FOREX market, is a relatively young phenomenon that appeared around 2006. At first, the phenomenon was perceived skeptically, however, like everything new that appears on the market.

The PAMM-account, as a financial instrument for investing in the FOREX market, is a relatively young phenomenon that appeared around 2006. At first, the phenomenon was perceived skeptically, however, like everything new that appears on the market.

Beginners of the Forex market treated this investment tool with great suspicion. But for 5 years the situation has changed dramatically, and the PAMM-accounts have become one of the most popular services among the beginners and also the average level of Forex traders because of the convenience of investing and the possibility of optimal diversification of risks.

The annual increase in the opening of PAMM-accounts in Russia per month is 10 times, that is, if, for example, in January 2015, 100 PAMM accounts were opened on one PAMM-site, in January 2016 - 1000, and in the same month 2017 - 10 000 accounts.

Similar statistics on the growth of the popularity of this financial investment tool indicate a rapid increase in the credibility of PAMM-accounts. After all, if they were excessively risky, inconvenient to use and not profitable, then to the present day they would disappear by themselves, without outside interference.

Initially, the PAMM-account, as a service for investing money, was offered by a limited number of forex brokers, but as the demand for this tool increases, by today, the number of Internet sites to enter the Forex market offering such an investment service has grown to several dozen. In addition, not all brokers use the name "PAMM-account", bringing to the market similar services under its own name.

What is a PAMM-account?

PAMM accounts - literally translated as a "percentage distribution management module".

PAMM-account is a mechanism of proportional participation in investing and distribution of profits and losses between all participants of the managed account, which are investors and the trader managing this account, to whom they trust decision making on transactions in the FOREX market.

By its functionality and profitability, the PAMM-account can be compared with shares in various mutual funds, in fact, with trust management of cash.

Example of work with PAMM-account on Forex:

An experienced and successful trader decided to create a personal PAMM-account on the site chosen by him, investing $ 10,000 of his own funds.

To this end, he published an open-ended agreement - an offer specifying the conditions for investors to join his account, namely: the percentage distribution of profits and losses between it (40%) and possible investors (60%), meaning that in the event of a PAMM income -40% of the account remains with the trader and 60% - investors, the minimum investment period is 1 month, the penalty (withholding) for the early withdrawal of funds.

The trader traded alone for six months, increasing by an average of 22% per month invested capital; Two people from different cities and countries - a novice trader and just an investor who wants to invest some of the available funds somewhere - paid attention to the trader's PAMM account. The result of their interest in trader trading was their joining to his PAMM-account: the newcomer invested $ 4,000, and another investor - $ 6,000.

As a result, the trader's managed capital was $ 10,000 + $ 4,000 + $ 6,000 = $ 20,000. With the optimistic development of the situation, the trader multiplied the PAMM-account by 15% and the funds from him were distributed as follows: from his own $ 10,000, the manager received $ 1,500, from the income of the newcomer he transferred 40% of $ 600 ($ 4,000 + 15%) or $ 240, from the second investor's income - 40% from $ 900 ($ 6000 + 15%), or $ 360, total: the manager earned $ 2,100 ($ 1500 + $ 240 + $ 360) $ 360 ($ 600-40%), another investor - $ 540 ($ 900-40%), thus, thanks to investors, the manager earned an additional $ 600 ($ 240 + $ 360), and investors, without applying

In case of unsuccessful Forex trading, the managing trader suffered a loss of 10% per month, that is, the aggregate capital of the PAMM-account decreased by $ 2000 ($ 20,000-10%), then the distribution of funds was as follows: the newcomer lost $ 400 ($ 4000-10%) , the second investor - $ 600 ($ 6000-10%), the managing trader - $ 1000 ($ 10,000-10%), while receiving a portion of investors' income it will not until their balances return to the initial level of investment.

What does this statement say? It is advantageous for the trader to manage when investors in the PAMM-account win, and it is not profitable when they lose their money, not to mention that some investors will want to completely leave this PAMM-account, while others will change their mind about joining it. The motivation of the managing trader is obvious, because if he does not provide an acceptable level of profitability to investors, he will lose initially additional income, then - reputation, and finally - his own investments.

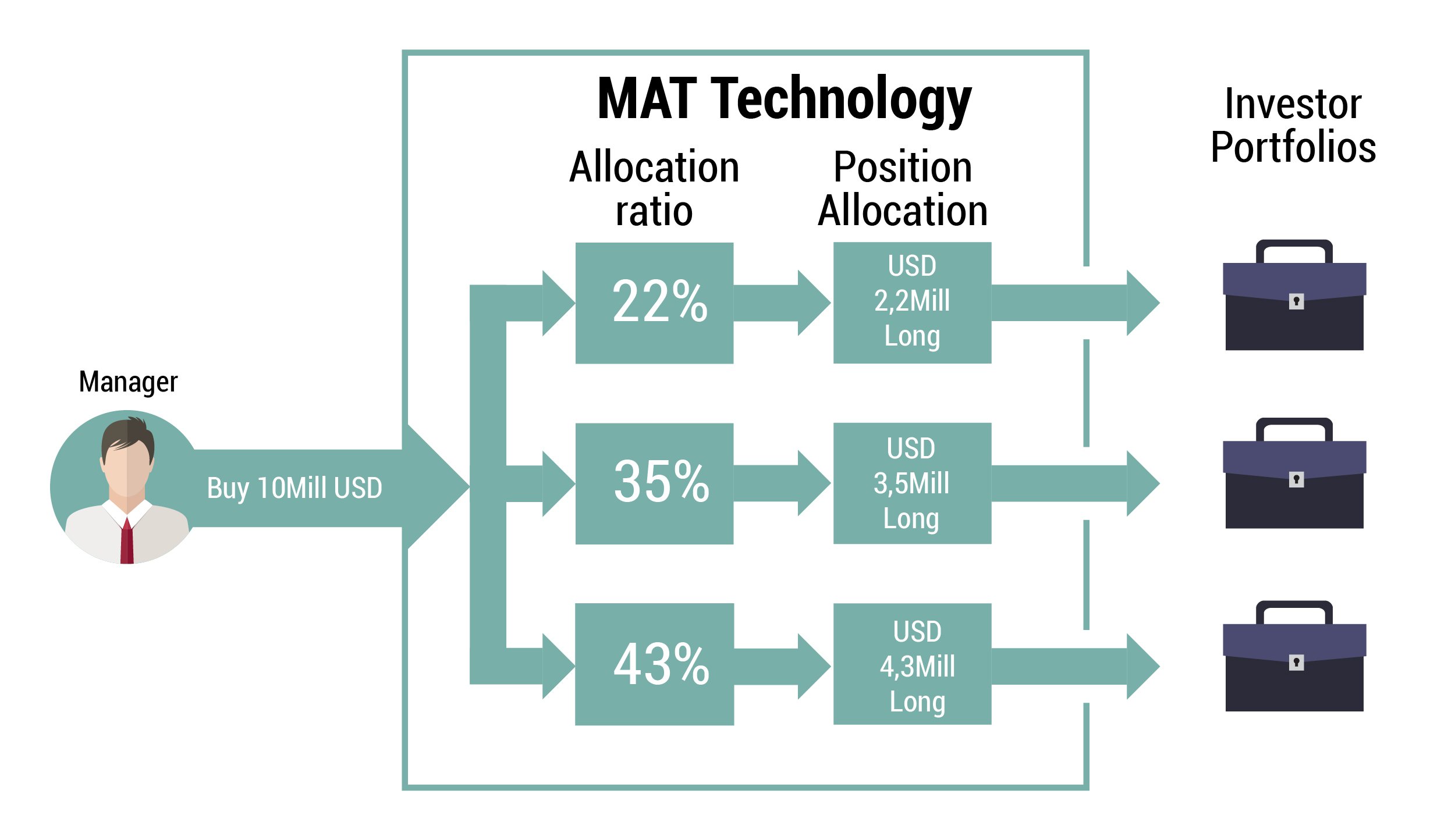

So, the PAMM-account is a technology of borrowing the market strategy of the managing trader by automatically projecting all the transactions (purchase and sale of currencies) conducted by him to the investors' capital, as a result of which the consolidated funds consisting of the manager's capital and investors of the PAMM-account undergo changes: all participants of the account receive income or suffer losses in proportion to their share.

Profitability of PAMM-accounts

All investments in the PAMM are conducted openly and publicly (only personal data are confidential).

On the Internet sites of forex brokers or on independent resources, you can observe the profitability of trading of certain traders.

The rating of PAMM-accounts on specialized sites is formed daily or "online". In addition to the profitability (for the selected period), the following indicators participate in the rating:

PAMM-account lifetime (creation date);

Investments of the managing trader (size of capital);

Maximum recorded drawdown;

Minimum investment for joining the account and others.

PAMM-account ratings are automatically sorted by profitability, but some resources offer a flexible system of configuring list data for a set of indicators. Continuous open statistics provide an opportunity for objective monitoring of PAMM-accounts for choosing the optimal investment option in this financial instrument.

How to choose the right PAMM-account

To invest in a PAMM-account, a novice investor needs to know a few simple things:

For the purpose of choice, it makes no sense to parse the dynamics of the PAMM-account for a period of one to three months, since this is a very short time interval: for a qualitative analysis of the trader's market strategy, the representative period of his Forex trading is at least six months;

It is considered a good indicator if the average monthly return on a PAMM-account is 10-20%; The ratio of income-earning transactions to unprofitable transactions should be at least 60/40%; The average acceptable loss rate can be considered as an indicator in 5% of the size of the PAMM-account, no more;

The riskiness of the behavior of the trader can be determined by the ratio of the number of open lots (contracts) per transaction (warrant) to the size of the PAMM-account: it is reckless to expose one currency for more than one lot for every $ 10,000;

If the managing trader is not known to you, and you can determine his experience on Forex only on the PAMM-account, it is better to choose those accounts that are open and work on real cash for more than 1 year;

The optimal period of investment can be considered a period of more than six months, during this time you can get the best result;

You need to invest in reliable, responsible and authoritative PAMM-sites, where you will not have problems with money entry / withdrawal, and you will get a high-level information and technical support service.

Of course, do not forget about the methods of risk reduction, in particular, about determining the maximum allowable loss rate (for beginners - no more than 30%), the number of loss-making orders in a row (no more than 6), the number of participants in the PAMM-account, etc. Finally, when investing in the PAMM mechanism, a novice investor should understand that he takes all risks for a choice: the account of the desired yield, the PAMM-site, the investment term, the terms of the offer and so on. In the end, the investor himself makes this choice, he himself controls the PAMM-account and can leave it at any time, if he stops it arranging.

TradetoolsFX is a developer of software for PAMM accounts.

Report

My comments